By all accounts, the post pandemic period in the US is characterized by a remarkable industrial transition. From the Covid-19 pandemic to climate change, the war in Ukraine, and rising tensions with China, macro forces and ample federal investments are prompting the re-shoring of advanced manufacturing and, relatedly, an accelerated decarbonization of the US economy.

This confluence of market dynamics and government investments are leading to a manufacturing renaissance. The Infrastructure Investment and Jobs Act (IIJA), the CHIPS and Science Act, the Inflation Reduction Act (IRA), and increasing Department of Defense’s appropriations are playing a significant role in upgrading infrastructure, incentivizing domestic production, fostering clean energy technologies, and bolstering national security. After decades of offshoring and outsourcing, the future of American manufacturing seems bright.

Yet advanced manufacturing, like all segments of the economy, does not exist in the ether or abstract. It comes to ground in real places and its success is dependent on the ability of a broad array of stakeholders – companies, federal, state and local governments, research universities, community colleges, infrastructure and energy providers, business chambers and special intermediaries – to design, finance and deliver integrated strategies that cross disciplines and jurisdictions.

US manufacturing is also not just about global companies like Intel or General Motors or General Dynamics. It is also about thousands of suppliers downstream. The US industrial transition is creating exciting opportunities for enterprises able to adapt quickly to the new demands of producers and consumers alike. The transition has the potential to spur inclusive growth if and only if supplier diversity and supplier development is baked into the process from the beginning, purposefully and intentionally.

Our team at Drexel University’s Nowak Metro Finance Lab, in collaboration with the Aspen Institute’s Latinos and Society Program, has started to map the spatial, policy, and practice dimensions of the US industrial transition. Our work naturally builds on a several-year partnership to maximize the procurement opportunities for Black- and Latino-owned enterprises that emerge from new federal investments; that partnership originally focused on public infrastructure spending and now must encompass manufacturing and clean energy projects.

Given the fast-moving nature of this industrial transition, we think it is essential to share our preliminary findings in hopes that purposeful actions can be taken across multiple sectors and layers of government. Our findings are as follows:

- The manufacturing boom is benefitting a diverse set of states, regions, and metropolitan areas, reflecting the distributed nature of manufacturing, both defense and civilian, that exists in the United States.

- Many mega-deals, however, are landing at the periphery of metropolitan areas or beyond, challenging the ability of stakeholders to connect all the necessary dots and realize the full potential of this resurgence for firms, people, and places.

- The disjointed geography of production presents specific challenges around enabling the full potential of Black- and Latino-firms to enter new markets and create new opportunities for wealth building.

- Many cities and metropolitan areas, often with their states, are pursuing a range of strategies that, while nascent and evolving, hold the promise of creating a bottom-up industrial policy that complements and furthers federal actions.

Each of these early findings are discussed in turn below.

A widespread boom across states and regions

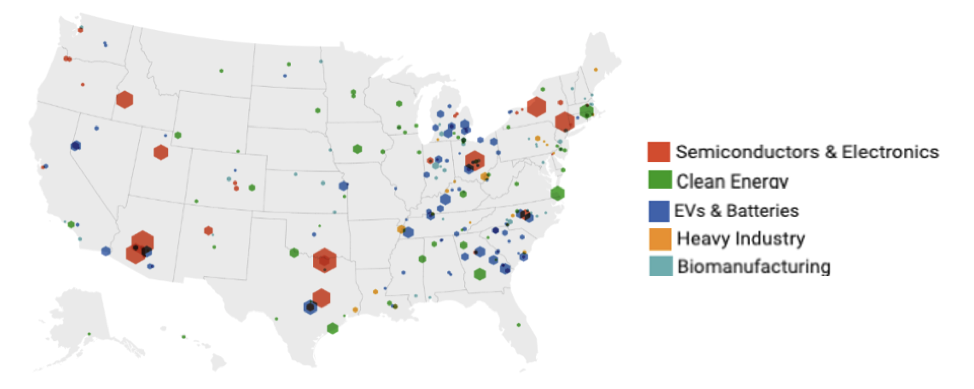

The manufacturing boom is expanding across the US, benefitting diverse states, metropolitan areas, and industries. As reported by the White House, recent private investments in a range of advanced manufacturing sectors illustrate the distributed nature of the US geography of production (Figure 1). For instance, 85% of dollars targeting the semiconductor supply chain are flowing to Arizona, Texas, New York, Ohio, and Indiana. At the same time, to optimize supply chain logistics, battery plants are being co-located with automotive plants along a north-south band from Michigan to Georgia. Finally, clean energy manufacturing investments in offshore wind concentrate on the East Coast, while California, Arizona, and Texas are playing a significant role in solar panel production. All in all, this manufacturing boom is benefiting a wide range of states following the dispersed nature of high-tech manufacturing specializations across the country.

Figure 1. Private investment during current administration in selected industries

Source: White House. (n.d.). Retrieved from whitehouse.gov/invest

The distributed nature of the manufacturing resurgence is good news for the country. The pre-pandemic economy was characterized by deep economic disparities between a small number of superstar metropolitan areas and the rest of the United States. Shifting market dynamics, distinctive advantages at the metropolitan and regional scale, local and state cross-sector collaboration, and unprecedented levels of federal leadership and funding can, in UK parlance, “level up” economic prosperity.

The metropolitan nature of the industrial transition

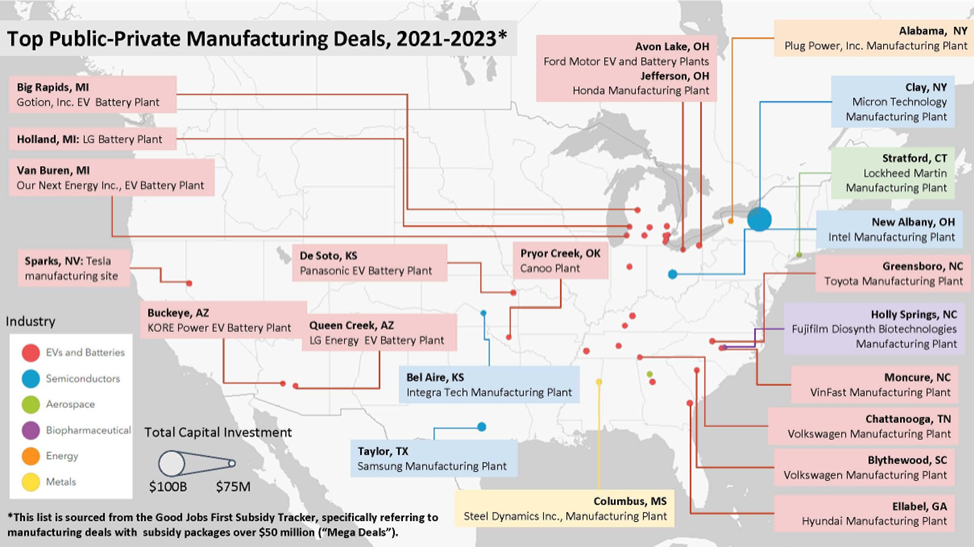

Metropolitan areas rather than states, of course, are the true organizing units of the domestic and global economy. To that end, our teams are trying to understand how the geography of the manufacturing resurgence is manifesting across and within metros. To do this, we gathered data from the Good Jobs First Subsidy Tracker, which sources from more than 1,000 economic development programs to describe announced subsidy packages and their receiving businesses. We filtered this data to focus on public-private deals announced between 2021 and 2023 with subsidy packages of $50 million or more (referred to as “mega deals” in the tracker). This search returned 37 mega deals and gave us some insight into where public investments are falling within regional economies. These mega deals are obviously a small portion of the manufacturing resurgence underway. We believe, however, that they provide early signals about where large factories are locating and the extent to which strategies are being holistically designed to maximize the impact of these industrial wins.

Large manufacturing firms are locating at the periphery of metropolitan areas and beyond.

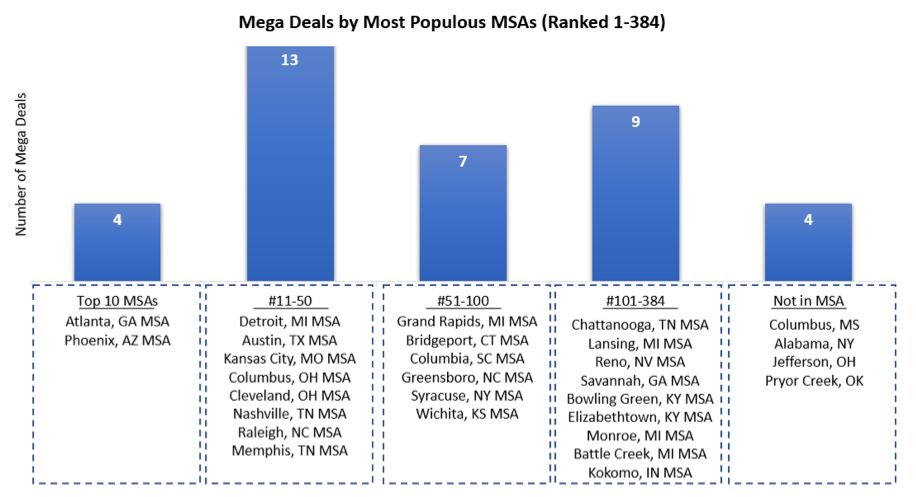

As seen in Figure 2, we mapped the 37 mega deals and found that 33 of them fall within metropolitan statistical areas (MSAs), three are located in micropolitan areas and one is located on tribal lands. Looking regionally across the country, we find that only four deals fall within the Top 10 Largest MSAs—two in the Atlanta MSA and two in the Phoenix MSA. Significantly, the Detroit MSA, the 14th largest MSA in the nation, captures five deals, all related to EV production (see Figure 3).

Figure 2. Top public-private manufacturing deals, 2021-2023.

Source: Map made by Nowak Metro Finance Lab (2023), based on the Good Jobs First Subsidy Tracker

Figure 3. Mega deals by most populous MSAs. Ranked 1-384.

Source: Nowak Metro Finance Lab (2023) based on Annual Estimates of the Resident Population for Metropolitan Statistical Areas in the United States and Puerto Rico as of July 2021, US Census Bureau

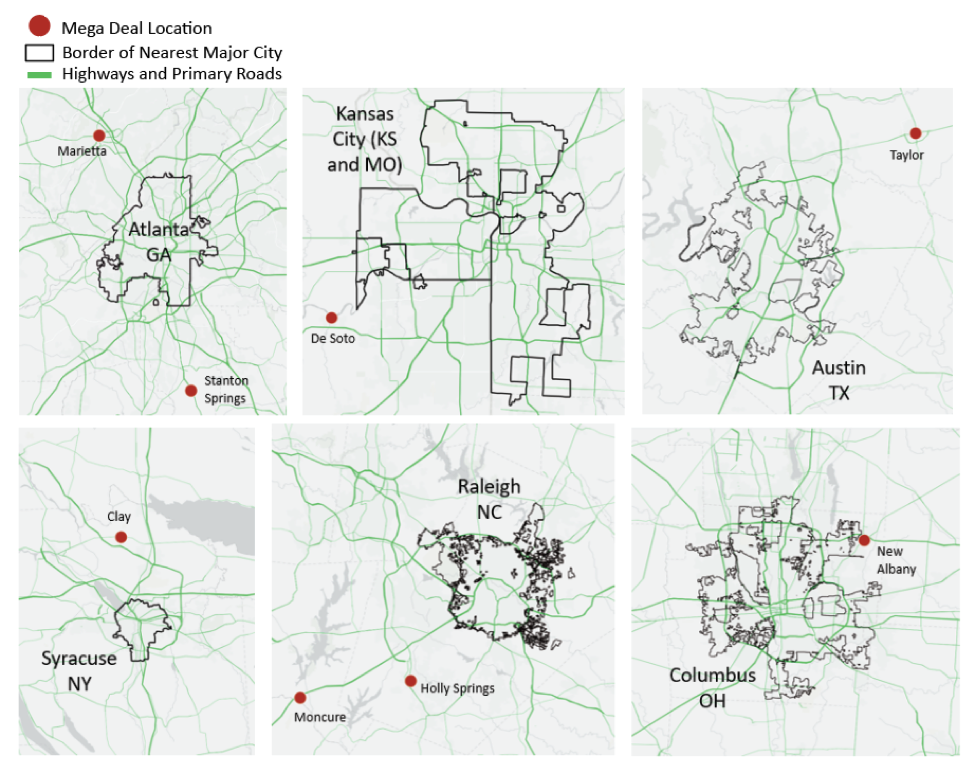

Looking within these MSAs, we find that 28 out of those 33 planned facilities are not located within the largest or principal city of their respective MSA, landing in communities often far from the core. This initial sample of deals suggests that the industrial production spurred by the IRA and CHIPS and Science Act will geographically disperse across metro areas and away from central cities.

In some respects, locating major manufacturing sites outside of core cities should not be surprising. Many production facilities in the sectors driving the manufacturing resurgence need large footprints and easy access to key transportation and logistics networks (Figure 4). Large manufacturing facilities, more often than not, take advantage of the cheaper land beyond urban cores and even suburban jurisdictions to accommodate their massive production processes and gain faster local approval.

Figure 4. Sample of mega deals and their locations

Source: Nowak Metro Finance Lab (2023); Mega Deal locations from Good Jobs First Subsidy Tracker

While large deals may generate headlines and excitement, they are not enough on their own to create the conditions necessary for sustained growth. The key to rebuilding a robust industrial base and ensuring long-term success lies in the creation of strong and sustainable ecosystems that support the manufacturing sector. Such ecosystems require the collaboration and coordination of a variety of stakeholders, including large manufacturers, small and medium-sized enterprises (SMEs), research universities, community colleges, state and local governments, infrastructure and energy providers, transportation and logistics companies, and specialized intermediaries. Together, these stakeholders must create an environment that supports manufacturing by fostering a skilled workforce, an efficient supply chain and logistics infrastructure, and a culture of innovation and continuous improvement. While these ecosystems may have been weakened by offshoring and other economic factors, they can be rebuilt with the right investments and policies in place.

Innovation, human capital, and small-scale manufacturing tend to concentrate locally. Cities are home to advanced research universities that can provide access to cutting-edge research and top talent, including engineering and design expertise as well as advances in technologies that cut across industries. As an example, 67% of DOD’s Manufacturing Innovation Institutes (MIIs) are located within the largest city of their MSA. These assets are even more important today given the evolution of advanced industries. This is not your parent’s manufacturing. As the Economist recently concluded: “In future car brands will be differentiated mainly by the experience of using them, which is now determined more by their software than their hardware.”

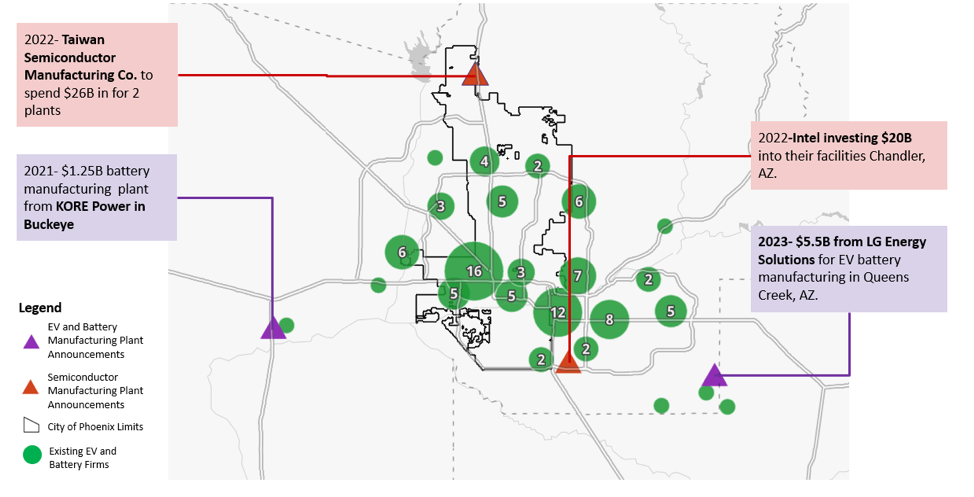

Large manufacturing firms also benefit from the concentration of specialized suppliers, skilled labor, and innovation networks. Experts estimate that for each Original Equipment Manufacturing (OEM) plant, there are on average 37 tier 1 sites, 166 tier 2 sites, and 602 tier 3 sites involved in the manufacturing process. In Figure 5, we can see the juxtaposition of large and small and medium sized manufacturing firms (primarily in the EV/Battery space) in Phoenix (albeit a city with a very large land mass).

Figure 5. Distribution of Small and Medium-Sized EV/Battery Firms across Phoenix, AZ

Source: Nowak Metro Finance Lab/ Data Axle 2023, “EV Manufacturing Firms” defined as NAICS codes 3361, 3362, 3363, 335312, 335910

An integrated approach can leverage the unique strengths and assets of each location. To fully capitalize on the potential of these manufacturing deals, it is essential to develop an integrated strategy that considers their geographic dispersion. This strategy should aim to connect the peripheral locations of large manufacturing sites to the broader metropolitan network of assets through applied research, workforce development, supply chain management and infrastructure to build strong regional manufacturing ecosystems.

Areas of attention

Collaboration between stakeholders is essential not only to maximize potential but also to address the challenges posed by industrial sprawl in metropolitan areas. In addition to social challenges such as a lack of workforce and supplier diversity, the manufacturing boom will also encounter logistical challenges due to the inadequacy of the current logistics and energy infrastructure.

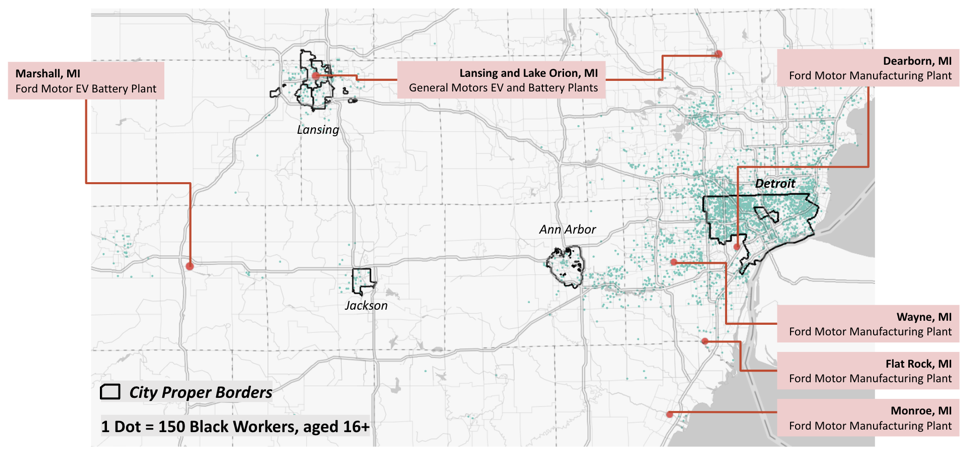

As manufacturing facilities and their supply chains expand into suburban and rural areas, it can create a dispersal of jobs that are difficult to access for workers who live in central cities and older suburbs. As research from the Brookings Institute in 2005 suggests, this spatial mismatch is particularly prominent for Black populations within metropolitan areas with high job sprawl. Michigan is an example of this phenomenon, where manufacturing jobs sprawl beyond Detroit along key highway networks. Figure 6 shows this spatial mismatch in Michigan, with the Black population concentrated in Detroit city proper, far from the public private manufacturing deals announced in the state over the last two years. To address this challenge, it is important to develop transportation and infrastructure systems that connect cities, suburbs, and rural areas. This can include expanding public transportation networks and workforce development programs that help to train workers for the specialized jobs that are being created in these expanding industries.

Figure 6. Where black population lives and top public-private manufacturing deals in Central Michigan.

Source: Nowak Metro Finance Lab (2023) based on Data for Employment Density: U.S. Census Bureau. 2023. LEHD Origin-Destination Employment Statistics (2002-2020). Accessed in April 2023 at onthemap.ces.census.gov. Good Jobs First Subsidy Tracker, specifically referring to manufacturing deals with subsidy packages over $50 million (“Mega Deals”).

The current logistics and energy infrastructure was not designed to handle the demand of the manufacturing boom. The revival of the manufacturing industry highlights the increasing importance of efficient transportation and logistics networks. The resilience of this industry is crucial to ensure that inputs and outputs are moved efficiently and effectively across the supply chain. According to a report by the Department of Transportation, the COVID-19 pandemic exacerbated challenges created by decades of underinvestment in our transportation infrastructure. These challenges include climate change impacts, congestion, container availability, infrastructure outages, last-mile freight delivery, warehousing capacity, workforce conditions, regulatory flexibility, and data availability. Another level of complexity emerges when one considers how the energy sector will supply sufficient power, particularly from renewable sources, to support these networks. The BIL is set to increase investment in the nation’s freight transportation and energy systems over the next decade, but coordinated efforts with manufacturing plant locations are needed to overcome these challenges.

There is a concerning lack of minority-owned firms in key strategic sectors, mirrored by federal spending patterns. At the national level, Black-owned businesses represent no more than 1% of all employer firms in construction, manufacturing, and utilities. Latino-owned businesses show a similar pattern: only in construction they account for 7% of employer businesses, with this figure falling to 4% in manufacturing and 1% in utilities. This couples with data from the U.S. Small Business Administration reflecting that federal contracting with Black and Latino-owned small businesses was abysmally low in 2021, at less than 4%. Other evolving and growing sectors such as clean technologies present different barriers for small and diverse businesses. Without intentional efforts, the business ecosystems in key sectors are at risk of overlooking minority-owned firms. This requires coordinated and firm-centric efforts to scale services that help these firms overcome barriers to accessing strategic supply chains and public contracting opportunities. These efforts should include providing access to capital, mentorship and training programs, fostering partnerships and collaborations, and scaling local agency best practices.

Maximizing the manufacturing moment: emerging local strategies

The US industrial transition, of course, is still in its early stages. In many respects, we are witnessing the first phase of the transition, catalyzed by market and geo-political dynamics, and fueled by unprecedented federal investments and new policies.

Cities and metropolitan areas are just beginning to catch up and pursue intentional and purposeful strategies. More than any other sector, advanced manufacturing reinforces the interdependence of cities, suburbs and rural areas and the assets they naturally bring to the table. Large companies and smaller supply chain firms alike need suitable sites for production activity, properly assembled, prepared, and zoned. They need access to a steady stream of qualified workers who can master the complex nature of advanced production, applied researchers who can continuously assist with product and process innovation, quality housing that can be affordable to workers of all incomes, and infrastructure of all types that enables the efficient movement of ideas, goods, services, workers, and energy, within and across metropolitan areas. Each part of a metropolis has critical roles to play in this industrial transition.

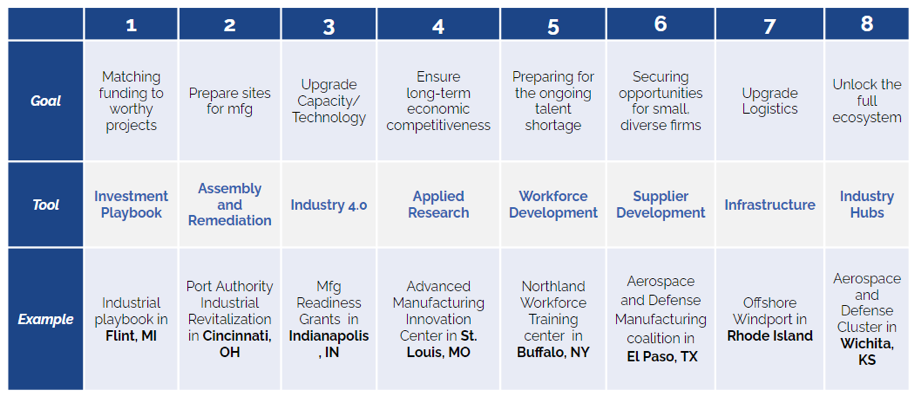

Fortunately, cities and metropolitan areas, often driven by networks of government, businesses, university, and philanthropic leaders, are inventing a new kind of bottom-up industrial policy on the fly. Figure 7 lays out the multi-pronged industrial policy that is emerging.

Figure 7. Early Policy Signals.

Source: Nowak Metro Finance Lab 2023

The range of interventions underway is broad and variegated.

With support from the Mott Foundation, Flint is in the process of developing an Investment Playbook that identifies a suite of specific projects—a Center of Excellence on Battery Recycling on Kettering University, a unified approach to talent development across three institutions of higher education, an Industrial Action Team to field mounting demand for industrial sites — uniquely dedicated to industrial transformation.

The Cincinnati Port is advancing site readiness strategies, in collaboration with state and federal agencies, to prepare sites for business retention and expansion and address vacant historic manufacturing corridors.

Indianapolis is stimulating private sector investments to modernize technologies, through Manufacturing Readiness Grants.

St. Louis, Missouri is establishing an Advanced Manufacturing Innovation District to serve the needs of Boeing and its suppliers in the defense aerospace sector.

Buffalo, New York is expanding a manufacturing-oriented workforce development center to meet the demands of the reshoring moment.

El Paso, Texas is establishing the El Paso Makes Advanced Manufacturing District to cluster small- and medium-sized businesses with research and innovation assets to bring them into the region’s established aerospace and defense supply chain.

East Providence is investing in a 33-acre riverfront parcel along the Providence Worcester Railroad to stand up a wind port at South Quay Marine Terminal, taking advantage of its natural assets to become a regional hub for the offshore wind industry.

Wichita, Kansas is honing its full ecosystem of firms, universities and intermediaries to cultivate and secure its strong position in aerospace and defense manufacturing.

Notably, four of the eight emerging best practices were winners in the $1 billion Build Back Better Regional Competition overseen by the Department of Commerce, an early version of federal investments in advanced industry clusters.

Given how urban and metropolitan areas routinely adapt best practices, we should anticipate that this emerging industrial policy will rapidly scale across the country, particularly as federal investments amp up. We should expect other institutions and stakeholders to get in the mix. Metropolitan planning organizations, for example, could play substantial roles in integrating infrastructure and industrial policies. Manufacturing extension partnerships could play a “glue role” in places where they are strong and trusted. Capital providers, perhaps even using the State Small Business Credit Initiative, could innovate on financial products and funds.

The industrial transition underway in the country is in its infancy and urban and metropolitan leadership is as well.

Conclusion

For the past several decades, cities and their metropolitan areas were told to plan for a post-industrial future. Now, almost overnight, they are being compelled to deliver an industrial transition of major consequence. The benefits of that transition could be quite high, creating opportunities for a broad array of communities as well a new set of firms.

Within this broader context, place matters. As our work is just beginning to illustrate, large firms, small suppliers, workers, and supportive institutions are widely distributed, both across and within metros. That leverages natural assets but also has the power, through physical distance, to undermine connections.

All this will require purpose and intentionality, across sectors, disciplines, institutions, and jurisdictions. It is only through radical collaboration that we can harness the full potential of American manufacturing and spur a period of inclusive growth.

Bruce Katz is the Founding Director of the Nowak Metro Finance Lab at Drexel University. Milena Dovali, Avanti Krovi and Victoria Orozco are Research Officers at the Nowak Lab.